Failure to Protect: the Deficiencies of the Tunisian Social Protection Framework

Tunisia's social protection mechanisms, originating in the early 1960s, have operated within a fragmented and exclusionary framework, falling short of embracing a comprehensive universal social protection (USP) system. Despite being lauded as a regional exemplar, it has inadequately addressed a spectrum of life-cycle risks, encompassing unemployment, paternity leave, the informal sector, undocumented workers, and child poverty.

This policy paper underscores the imperative for Tunisia to cultivate sustainable and inclusive economic growth while establishing an all-encompassing, universal, and enduring social protection system that safeguards the most vulnerable segments of society. The prevailing social protection system is characterised by significant deficiencies, characterised by high exclusion rates and inadequate safety nets. In response to an exacerbating economic crisis, successive governments have veered towards expanding social assistance programs targeted at the most vulnerable groups. However, the inadequacies of these policies have been conspicuously revealed by recent internal and external factors, including the 2020 COVID-19 pandemic, the inflation crisis stemming from the Russo-Ukrainian War in 2022, and Tunisia's ongoing economic and political tumult.

The existing social protection mechanisms predominantly hinge on social assistance programs employing poverty-targeting strategies, which have demonstrated ineffectiveness in proactively forestalling poverty and identifying vulnerabilities for timely intervention. These schemes predominantly cater to formal workers in the private and public sectors, thus leaving informal workers, employees of small and medium-sized enterprises, and the "missing middle" bereft of formal social security coverage, ultimately culminating in a fragmented social protection system.

In light of these challenges, this policy paper advocates for the adoption of progressive and inclusive policies to overhaul Tunisia's social protection system, transitioning from an exclusionary and fragmented model to a universal framework. This transformation necessitates the extension of coverage to informal workers, migrants, and those engaged in small enterprises, the enhancement of technical capacity, a broader definition of poverty, and the implementation of these reforms through progressive taxation and resource reallocation.

To cite this paper: Sahar Mechmech , Kais Attia ,"Failure to Protect: the Deficiencies of the Tunisian Social Protection Framework", Civil Society Knowledge Centre, Lebanon Support, 2023-10-01 00:00:00. doi:

[ONLINE]: https://civilsociety-centre.org/paper/failure-protect-deficiencies-tunisian-social-protection-framework

Executive Summary

Since its establishment in the early 1960s, Tunisia's social protection mechanisms have operated predominantly under a fragmented, exclusionary, and hybrid framework, rather than embracing a comprehensive system of universal social protection (USP). Despite being lauded as one of the more advanced models in the region, the Tunisian approach falls short in extending coverage to address a number of life-cycle risks, such as unemployment, paternity leave, the informal sector, undocumented workers, and child poverty.

While recommendations for a legal framework for USPs exist, such as those outlined by the International Labour Organization (ILO)[1] and the blueprint set out by the Sustainable Development Goals (SDG), the Tunisian framework only covers certain social protection schemes. These are limited to social security for full-time workers in the private and public sector, and some social assistance programs that target the poorest segments of the population.

Following the 2011 revolution and the ensuing economic deterioration, successive governments have enforced austerity measures mandated by the International Monetary Fund (IMF). They prioritised expanding social assistance programs over reforming the contributory or universal schemes.

The Tunisian social protection system is based on four main programs: two social security funds — the Caisse Nationale de Sécurité Sociale (National Social Security Fund, CNSS) and the Caisse Nationale de Retraite et de Prévoyance Sociale (National Pension and Social Insurance Fund, CNRPS) — and several social assistance programs, the Programme National d’Aide aux Familles Nécessiteuses (National Programme of Assistance to Needy Families, PNAFN), the Assistance Médicale Gratuite (Free Medical Assistance, AMG), and the Caisse Générale de Compensation (General Compensation Fund, CGC).

The COVID-19 crisis exposed systemic deficiencies: social security schemes exclude large parts of the population and programs of social assistance often fail to reach those who qualify for benefits due to technical and logistical flaws in the process of registration, targeting, payment, and delivery. To add to these technical challenges, public spending on social protection remains one of the lowest in the region. As a result, and as this report will show, a majority of beneficiaries have lost their trust in public services, state institutions, social security schemes, and assistance programs.

To address these flaws, this policy paper recommends the adoption of progressive, inclusive policies that aim to transform the current system from its fragmentary and exclusionary model to a universal social protection system. This framework should include unemployment insurance, pension plans covering workers in the formal and informal sectors, and a reformed healthcare scheme. The system should also extend social protection to migrant workers, casual and temporary workers, day labourers, domestic workers, unpaid family employees, and workers in household enterprises and small firms.[2]

Furthermore the system's technical capacity to implement social protection programs can be improved by adopting a broader multidimensional definition of poverty. Existing services can be substantially enhanced by recruiting more trained staff, upgrading equipment, and enhancing data collection. This can be implemented and realised through a program of progressive taxation and the reallocation of resources.

Introduction:

In February 2023, Tunisia recorded an inflation rate of 10.4%[3], an official unemployment rate of 15.2%, and a GDP growth rate of only 1.6%[4]. The country’s economic crisis finds its roots in a balance of payment (BoP) deficit, a state budget deficit, a commercial balance deficit, and weak growth in the private sector.

The crisis has pushed a large part of the population into a state of precarity, rendering them susceptible to increasing risks and instability, such as unemployment, low wages, informal work conditions, and poverty. On the other hand, the often-praised social protection system[5] has failed to address these vulnerabilities. This paper argues that to protect the most vulnerable segments of society, Tunisia needs to stimulate sustainable and inclusive economic growth, and establish a comprehensive, universal, and sustainable system of social protection.

Tunisia's current social protection system exhibits significant flaws such as high exclusion rates and threadbare social safety nets[6]. In response to the worsening economic crisis, successive governments have shifted their attention towards expanding social assistance initiatives, ostensibly aimed at reaching the most vulnerable segments of the population. However, the limitations of these policies have been laid bare by recent internal and external factors, notably the 2020 COVID-19 pandemic, the inflation crisis following the Russo-Ukrainian War in 2022, and the longstanding economic and political turmoil in Tunisia.

These crises exposed vulnerabilities in healthcare and food security, and underscored how the existing social protection system, or its absence, has left a substantial part of the population teetering on the edge of precarity. The World Bank stated in September 2022 that, “COVID-19 […] reversed the gains made in reducing poverty, inequality, and gender-based gaps. Poverty is estimated to have increased from 14% of the population pre-COVID to 21% in 2020, with most of the impact being felt by the poorest households and many more now are vulnerable to falling back into poverty. Inequality (measured using the Gini coefficient)[7] is estimated to have also increased from 37 to 39.5.”[8]

The current social protection mechanisms depend predominantly on social assistance programs, primarily employing poverty-targeting strategies. These involve the identification of economically disadvantaged segments of the population and the allocation of limited resources to assist them.[9] As chapter two of this report will show, this approach has proven ineffective in proactively preventing poverty and identifying vulnerabilities in order to prioritise, mitigate, and remedy them.

The existing schemes are exclusionary and include only formal workers in the private and public sectors. This leaves informal workers and employees of small and medium-sized companies, the so-called “missing middle”, without any formal social security coverage. The social protection system is, in fact, divided.

Furthermore, the ongoing austerity policies, including privatisation programs and the gradual removal of subsidies — promoted by the IMF since Tunisia's adoption of a structural adjustment plan in 1986 — persist to this day. This plan focuses primarily on poverty reduction rather than prevention, as exemplified by the 2023 reforms designed to replace food subsidies with a more targeted cash transfer program.[10]

This policy paper examines the design of the Tunisian social protection system, its historical development following IMF interventions and recent policy measures, its flawed processes and mechanisms, and the lack of public trust and satisfaction with service provision to argue that it is an inefficient and exclusionary system. The system’s shortcomings — multiplied in light of the current economic and political crises — require interventions on a number of policy levels which will be elaborated in the recommendations section below.

Understanding Social Protection

People can face the risk of poverty and vulnerability at different stages of their lives, whether due to illness, changes in employment status, family dynamics, disability, discrimination, or the natural process of aging. The concept of USP views social protection as a fundamental human right and strives to safeguard all individuals from potential risks, ensuring they have access to a basic level of resources to maintain a dignified standard of living.[11]

Rather than poverty reduction, USP relies on poverty prevention. As such, it is based on three main pillars: universality, comprehensiveness, and adequacy.[12]

Universal Social Protection is universal. Under USP, all people will have access to social protection programs and measures, regardless of attributes such as race, wealth, income, gender, citizenship, or immigration status. To achieve universality, social protection includes two schemes: contributory-based social security schemes and tax-funded social benefits and assistance.[13]

Universal Social Protection is comprehensive. Beneficiaries must be protected from the cradle to the grave against all potential risks. Comprehensiveness denotes the risks covered by social protection. This includes child social protection, protection for illness, unemployment, disability, maternity/paternity leave, old age, and any other potential risks.[14]

Universal Social Protection gives adequate benefits. Adequacy describes the extent to which benefits can guarantee a decent life. Social protection safety nets should provide citizens with the minimum requirement necessary to maintain an adequate standard of living. Pensions, for example, are of little use if they cannot cover the minimum living costs.[15]

The international human rights framework, international social security standards, and the 2030 Agenda for Sustainable Development have all pledged to incorporate USP in their frameworks. They have outlined various actions to facilitate this process. However, it is important to note that there is not a one-size-fits-all model for achieving USP. National governments can adopt different mechanisms and programs to establish USP and social safety nets that vary in scope and type. These programs can address a wide range of risks, including child poverty, sickness, disability, and old age, through instruments such as child food programs, unemployment benefits, pensions, health insurance, and cash transfer programs.

While many countries, whether high-, middle-, or low-income, have made substantial strides in implementing social protection schemes over the past few decades, it is worth acknowledging that austerity measures and privatisation have, in many cases, hindered or reversed this progress. This is evident in the case of Tunisia.[16]

Overview of Social Protection in Tunisia

The Tunisian social protection system is based on four main programs: the two social security funds — the Caisse Nationale de Sécurité Sociale (CNSS) and the Caisse Nationale de Retraite et de Prévoyance Sociale, (CNRPS) — and non-contributory social assistance programs such as the Caisse Générale de Compensation (General Compensation Fund, CGC) that subsidise goods and services such as food and energy; the Programme National d’Aide aux Familles Nécessiteuses (National Programme of Assistance to Needy Families, PNAFN); and the Assistance Médicale Gratuite (Free Medical Assistance, AMG).

Caisse Nationale de Sécurité Sociale (CNSS) and Caisse Nationale de Retraite et de Prévoyance Sociale (CNRPS)

The CNSS (for the private sector) and CNRPS (for the public sector) are the two main social security funds for workers in the formal sector. The CNRPS was created in 1985 and covers local authority workers and employees of state-owned enterprises. It provides benefits such as payment of retirement and death pensions, maternity leave, health coverage, and paid leave.

To qualify for pension benefits, individuals must meet certain requirements such as making at least 120 months of contributions to the scheme and reaching the standard retirement age of 62, unless the individual has performed arduous work, in which case early retirement can be granted at the age of 55. Public sector employees are guaranteed a minimum pension benefit of the minimum wage (approximately 400 Tunisian Dinars (TD) or 100 United States Dollars (USD)).[17]

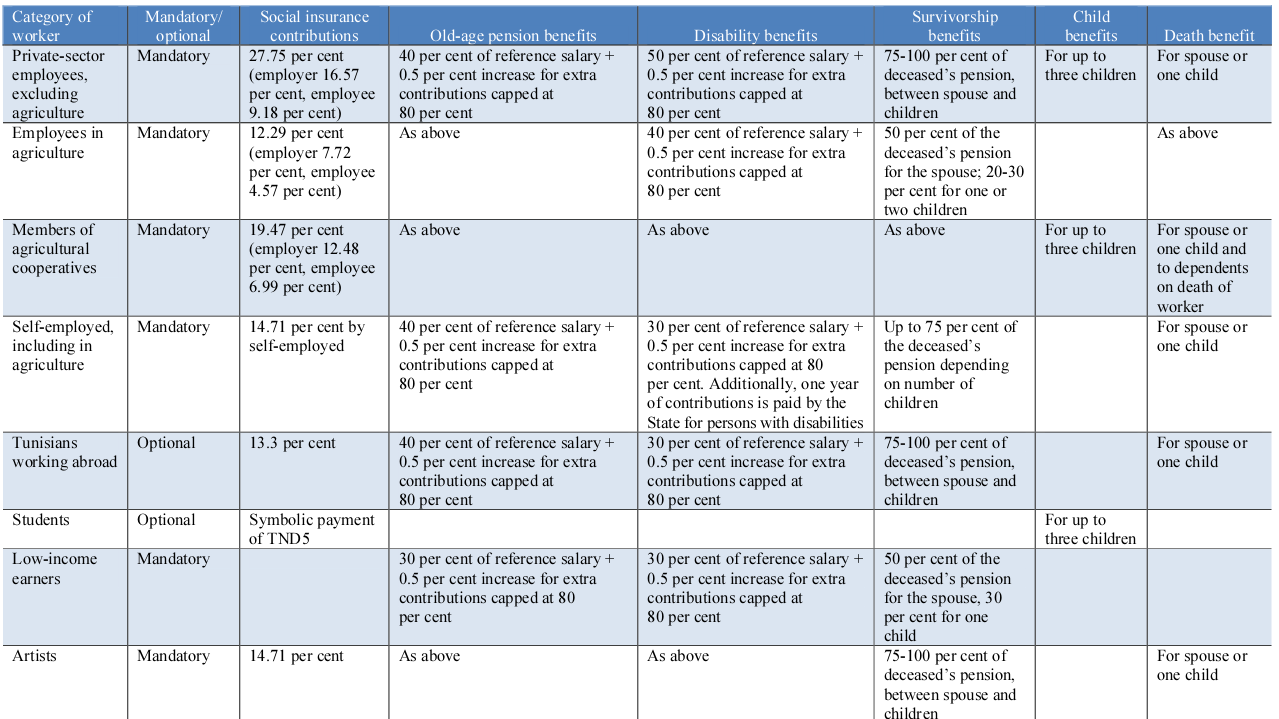

The CNSS was created under Law No. 60‐30 on 14 December 1960.[18] It provides similar benefits to those offered by the CNRPS and has, since its inception, implemented a wide range of programs that have achieved varying levels of success over the years. As Figure 1 shows, the CNSS appears to encompass a large portion of the Tunisian working class. However, as will be discussed later, the programs have failed to draw contributors (and thus beneficiaries) from low income-earners, agricultural workers, migrant workers, and workers in the informal sector. These workers are locked out of social security schemes.

Figure 1: Overview of CNSS social insurance schemes (Source: ESCWA)[19]

Caisse Générale de compensation (GCC, the General Compensation Fund)

Since 1970, food and energy subsidies have been administered by the Caisse Générale De Compensation, under the stewardship of the Ministry of Commerce. These subsidies were initially introduced as a universal program with the goal of ensuring access to essential food items and energy for all citizens. However, international financial institutions (IFIs), particularly the IMF, downplayed their importance and questioned their effectiveness. As far back as the 1986 structural adjustment program, IFIs have insisted on cutting these subsidies.[20]

These austerity measures persisted following the 2011 revolution. After initially increasing subsidies from 2.5% of GDP to 7% by 2013, the post-revolution governments began to gradually phase out food and energy subsidies in 2017 in response to budgetary constraints. New IMF loans came with the stipulation that Tunisia should progressively reduce these subsidies. Consequently, successive governments complied with this diktat.[21]

In 2021, the list of subsidised items included grain products such as semolina, flour, couscous, and white rice, certain bread types, vegetable oil, some varieties of cow milk, sugar, and coffee.[22]

PNAFN

The Programme National d’Aide aux Familles Nécessiteuses (PNAFN) was launched in 1986 to alleviate the adverse social consequences unleashed by austerity measures the IMF mandated in the early 1980s. The program was introduced following extensive protests, commonly referred to as the "bread riots", which swept the country from December 1983 to January 1984. These protests were triggered by the doubling of the price of bread.[23]

In this context, the PNAFN emerged as the most extensive direct cash transfer program in Tunisia, using the level of income as the primary criterion. By setting a poverty threshold of 180 TD (approximately 60 USD or 0.16 USD per household per day, much lower than the World Bank’s poverty line at the time of 1.90 USD per person per day)) per household per year in urban areas and 95 TD (approximately 30 USD) in rural areas, the program identified around 79,000 households living in poverty.[24]

The ineffectiveness of the PNAFN program became apparent when the expected number of beneficiaries increased from 79,000 in 1986 to 101,000 in 1992, demonstrating the exacerbation of poverty in the country.[25] As this report later shows, the program, which relied on family income as its primary principle standard, was ineffective in providing adequate support for families facing rising inflation alongside stagnating wages.

AMG

The Assistance Médicale Gratuite (AMG) is a social health provision program established by Law 1-63 on July 29th 1991) and is funded through the Ministry of Public Health. It provides free or highly-subsidised healthcare for low-income households. The program is divided into two sub-programs, AMG 1 and AMG 2.

AMG 1 provides free healthcare to poor households already enrolled in the PNAFN program. Healthcare is granted for a maximum of five years and is subject to national limits and regional quotas. In 2015, the coverage rate for AMG 1 was estimated at 7.3% of the population.[26]

AMG 2 provides healthcare at reduced prices, including co-payment for hospital visits. The program targets households who do not meet the PNAFN requirements but are close to the national poverty line[27]. Eligibility for AMG 2 is granted for five years and validated annually through a payment of 10 TD (approximately 3 USD). The eligibility criteria depend on the size of the family, and its income.[28]

Deepening inequalities: the flaws and challenges of the system of social protection in Tunisia

As highlighted above, social protection measures and policies in Tunisia have, from the 1990s onwards, been geared mainly towards social assistance programs, targeting those deemed most vulnerable or poorest in society. Currently proposed policies outlined by the government and IFIs, such as replacing the subsidy system with direct cash transfers, are a continuation of this approach.

This section analyses the current social protection system in Tunisia to expose the flaws, challenges, and weaknesses within the current system and its programs. It shows how structures and practices of fragmentation, exclusion, discrimination, and a lack of a coherent policy in the realm of social protection lead to a deepening of inequalities and vulnerabilities.

Excluded and/or discriminated: The unemployed, informal and migrant workers, and women

According to the Institut National De La Statistique (Tunisian National Institute of Statistics, INS), the unemployment rate in the second quarter of 2023 amounted to 15,6%, slightly lower than in the first quarter. Among the unemployed, 38,1% were youths between the aged 15 to 24[29]. Similarly, informal work is prevalent in Tunisia, with an estimated rate of around 45% in 2019[30].

The contributory social security system is geared towards those formally employed in the private and public sectors. Unemployed and informal workers are not eligible for any benefits under the CNSS or the CNRPS.

The issue impacts both public and private sector workers because there are no established mechanisms to ensure a basic income for the unemployed. However, severance pay is available in certain situations. Highly qualified first-time job seekers can access income support through schemes such as the AMAL youth employment program. Financial aid, healthcare, and family allowances are also accessible to individuals experiencing job loss or hardship, however the eligibility criteria remain stringent. Support is only given to individuals who have been employed at the same company for at least three years and have lost their jobs due to economic or technological reasons.[31]

Moreover, the procedural requirements associated with seeking assistance can create obstacles for the unemployed. Employers are tasked with filling out and delivering support requests on behalf of their former employees. As a result, the coverage rate for these benefits remains low.[32] In 2002, the Tunisian government introduced the Precarious and Low-Income Workers (RTFR) scheme to provide vulnerable low-income workers with social security. However, this scheme did not extend to those in the informal economy, seasonal workers, and day labourers, such as fishermen, domestic workers, and craftsmen.[33] The scheme requires a validation of at least 45 days of work with the same employer, which disqualifies most informal workers.[34]

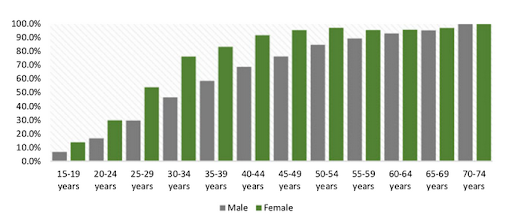

Figure 2 : Increasing cumulative frequencies of informal employment by age and gender structure in 2014 (Source: Ben Cheikh and Moisseron, 2021)[35]

As of 2019, 27,1% of workers in the informal non-agricultural sector are employees, while 83,2% are classified as self-employed.[36] Figure 9 shows that job informality is more prevalent among women and older adults, both of whom are vulnerable groups of society. More recent figures on gender disparity in work informality confirm that 31,9% of employed women work in the informal sector.[37] With a lack of social protection mechanisms, these groups risk further marginalisation. The absence of social protection for the informal sector becomes even more apparent when we take into account how widespread informality is across the country.[38]

Furthermore, Tunisia’s social protection schemes exclude temporary and undocumented migrants and those without a formal employment contract, making access to social security impossible for them.[39] While NGOs and international organisations do provide some healthcare solutions for irregular migrants, it seems that assistance components, such as cash transfer programs, are primarily oriented toward residing nationals. The legal residency status for foreigners in Tunisia is typically dependent on their compliance with residency regulations and the acquisition of a work contract. The status is typically granted under stringent conditions and must be renewed yearly.

Refugees registered with the UNHCR have less stringent residency conditions, but they are barred from working.[40] The absence of universal social protection mechanisms for migrants coupled with a fragile economic structure have left undocumented immigrants in a state of precarity. They can neither support themselves financially nor access basic health services.

Moreover, the Tunisian social protection system discriminates against women on many levels. As discussed above, household-based definitions of poverty tend to exclude poor women in non-poor or poor households, as well as women who experience gender-based financial violence. This involves the exploitation of a woman's financial vulnerability, often through controlling access to essential resources. The victim depends on the abuser, particularly for the financial support of children. Examples of this form of economic violence include restricting access to funds and credit, excluding the victim from financial decision-making, and exercising control over matters related to healthcare, employment, and education among others. Furthermore, economic abuse can persist even after the woman has left the relationship as ex-partners may intentionally undermine a woman's attempts to secure and maintain employment (Fawole, 2008). This comes as no surprise in a country where over half of women have experienced some form of violence in public spaces.[41]

Another gender-specific social protection policy that discriminates against women is the issue of parental leave. In Tunisia, maternity leave is one month long, with the option of a one-time extension for one month contingent on the submission of a medical certificate in which a physician deems it medically indicated. This period is widely considered excessively short and does not meet the internationally recognized standards of 12 weeks established by the ILO Convention No. 183[42]. Such a short period does not allow women sufficient time to recuperate after childbirth, nor does it allow for maternal-infant bonding, nor adequate nourishment of the newborn.[43]

Paternity leave policies, which are currently limited to just one day, have adverse consequences for women in several ways. Firstly, they perpetuate existing biases against women within the labour market since employers often prefer to have their employees readily available and may wish to avoid giving them extended leaves or lose them from the workforce altogether. Secondly, employers might be more inclined to hire or promote men, who are typically expected to take less time off when a child is born.

This reinforces prevailing assumptions that the mother will primarily assume the unpaid labour of child-rearing. Consequently, women may face greater pressure to take more time off from paid employment to attend to unpaid caregiving responsibilities, further exacerbating their time poverty and limiting their ability to engage in activities that contribute to their social and human capital development, as well as hindering their earning potential.

Inequalities of social spending

Tunisia's public social expenditure on health, education, and social protection is generally on par with other middle-income countries. Between 2014 and 2019 it ranged between 12% and 13 % of the GDP. Social expenditure rises to 20%, once subsidies, support for farms, environmental protection, labour market interventions, employment generation, and housing and community amenities, are factored in.[44] Public social expenditure, in general, has been increasing since the 2011 revolution, primarily in response to the demands and grievances expressed by the population. The largest share of these expenditures was for the education sector (37% of the state budget in 2021), followed by social protection,including subsidies, and healthcare.[45]

However, the COVID-19 pandemic exposed the challenges of underfunding and under-staffing in the public healthcare system. Doctors, nurses, technicians, hospital beds, and medical equipment were all lacking.[46] There remains a high burden on households to cover out-of-pocket expenses (42.9% in 2019 as % of current health expenditure)[47], while public health care services are often of substandard quality (lack of equipment and personnel), and access to health services is not equitable between regions.[48] The Ministry of Public Health’s budget in 2023 accounted for only 6.79% of the state expenditure.[49] This falls short of national and international commitments. For example, Tunisia has agreed, through the WHO 2001 Abuja Declaration, to allocate at least 15% of its annual budget to improve the health sector.[50] In contrast, the Ministry of National Defense and the Ministry of the Interior, account for 6.95% and 10.57% of the national budget, respectively.[51]

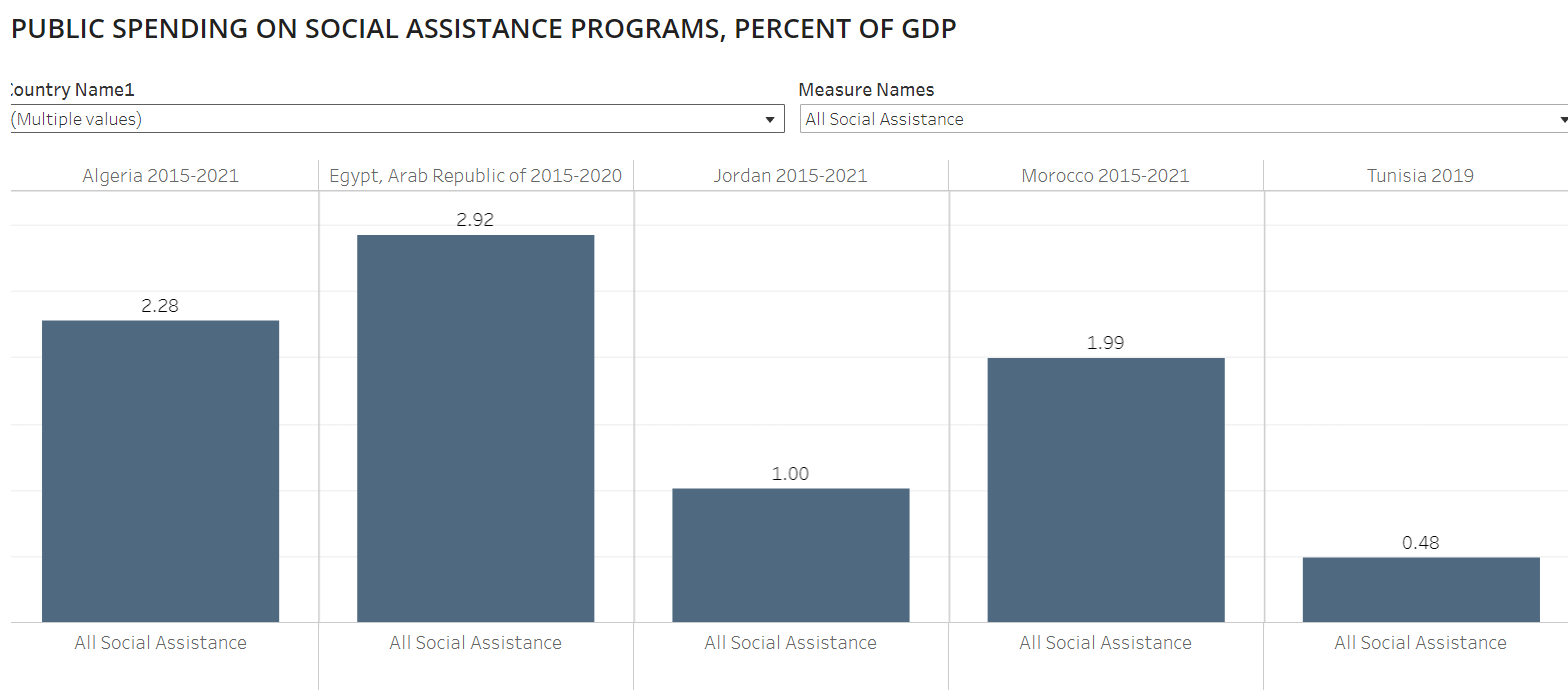

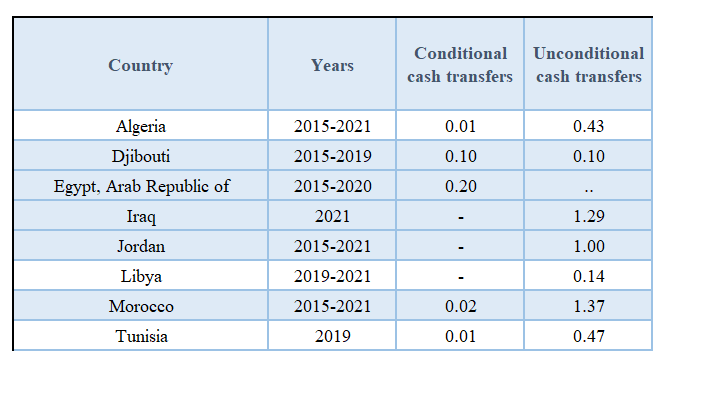

Despite an increase in spending on social assistance in 2020 in response to the pandemic and efforts to safeguard vulnerable populations, expenditure on these programs continue to lag behind those of other countries in the region, such as Egypt and Morocco (Figures 3 and 4).

Additionally, several critical areas continue to be overlooked, including support for families and children, housing assistance, and research on social protection, with each of these sectors receiving less than 2% of the total budget.[52]

Figure 3 : Public Spending on Social Assistance Programs, Percent of GDP (Source: World Bank)[53].

Figure 4 : Public Spending on Cash Transfer Programs, Percent of GDP (Source: World Bank)[54]

Exclusion errors in targeting programs

Apart from the inadequate allocation of resources for social protection programs, there are also several technical challenges that impede these programs from effectively accomplishing their goal of protecting individuals from risks.

Many individuals and families who truly need these benefits are deemed ineligible for a variety of reasons. These exclusion errors arise from various factors, including the government's definition of poverty, the methodologies employed to assess it, and the lack of up-to-date and comprehensive data.

In Tunisia, poverty is evaluated using income-based metrics or proxy-means testing, typically determined at the household level. However, both of these methods have limitations that lead to the exclusion of many individuals from being identified as poor. For example, an income-based definition, as opposed to a multidimensional approach, neglects to account for access to crucial resources. This means that a person living in poverty but within walking distance of a school or hospital is assessed differently from someone living farther away, even if their access to essential services varies significantly.

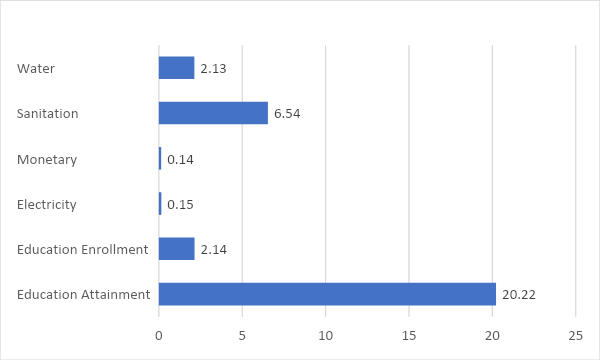

Various factors, including access to sanitation, clean drinking water, and public transportation, play significant roles in determining poverty levels. For instance, based on 2015 data and using a poverty threshold of 1.9 USD per capita income per day, only 0.15% of the population would be considered poor. However, when additional factors are considered, the percentage of people living in poverty increases significantly. It rises to 2.13% when factoring in access to clean water, 6.54% when considering access to sanitation, and a notable 20.22% when taking into account access to education. These numbers highlight how different dimensions and criteria can substantially influence the measurement of poverty rates[55] (Figure 5).

Figure 5: Multidimensional Poverty Measure and Deprivation Indicator, Share of the Population (%) (Source: World Bank)[56]

Assessing poverty at the household level rather than the individual’s, introduces its own set of biases. This approach assumes that resources within a household are distributed equitably among its members, which may not accurately reflect the reality of resource allocation and power dynamics within households. Women and children, for instance, often receive fewer resources, such as food.[57] This measure fails to record the numbers of poor people living in non-poor households, such as unmarried women with no income of their own, elderly people with little or no pensions, people with disabilities, and people facing economic discrimination in an abusive household.

Besides income, certain social assistance programs use other poverty measures that rely on proxy-means testing, which in turn depends on household consumption survey data. Recent studies on using proxy-means testing for social protection targeting have revealed that this approach was “both inaccurate and arbitrary. The mechanism suffers from high in-built design errors, additional errors introduced during implementation, and infrequent surveys, meaning that it cannot respond to the dynamic nature of household incomes. It also generates conflict and divisions within communities, ultimately weakening their cohesion.”[58]

Beyond the issues related to definitions and measurement approaches, there is a persistent problem with the quality of the data collected. Poverty figures in Tunisia, including the latest report on poverty published by the National Institute of Statistics in 2019, are based on household survey data from 2015. This data, which is eight years old, presents significant limitations in accurately monitoring poverty trends and assessing the effectiveness of poverty-targeting policies and other social protection measures.

The most recent information can be traced back to a World Bank report from 2022 that states that “COVID-19 […] reversed the gains made in reducing poverty, inequality and gender-based gaps. Poverty is estimated to have increased from 14% of the population pre-COVID to 21% in 2020, with most of the impact being felt by the poorest households and many more now vulnerable to falling back into poverty. Inequality (measured using the Gini coefficient) is estimated to have also increased from 37 to 39.5.”[59]

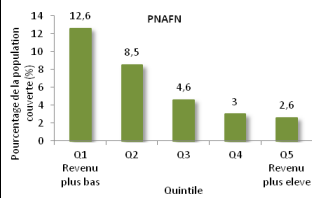

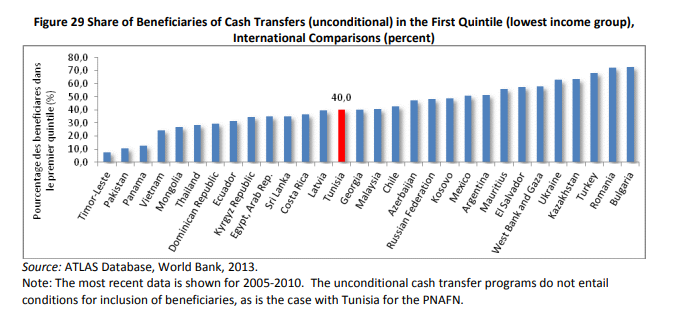

The shortcomings and deficiencies in including and excluding people from social assistance programs are evident in the notably high exclusion rate observed in the PNAFN program. In 2005, this program provided coverage to merely 12.6% of households within the lowest quintile and excluded more than 85% of the poorest 20% of households (Figure 6). Additionally, 40% of program beneficiaries belonged to the poorest fifth of the population (Figure 7). These statistics highlight the significant gaps and limitations in effectively targeting and reaching the most vulnerable individuals and households in need of aid.

Figure 6: Coverage Rate of Cash Transfer Program, PNAFN, by Quintile-percent 2005 (Source: World Bank)[60]

Figure 7: Share of Beneficiaries of Cash Transfers (unconditional) in the First Quintile (lowest income group) (Source: World Bank)[61]

Lack of trust and satisfaction in all public services and institutions

Exclusion errors, lack of adequate investments in healthcare infrastructure, and a limited grasp of essential concepts such as poverty have collectively undermined people’s trust in public services and the institutions responsible for providing social protection.

According to a 2021 study conducted over a 12-month period, some 44.9% of the public health service beneficiaries expressed dissatisfaction with public health institutions and the services they are supposed to provide. These percentages vary by region. In the more economically disadvantaged regions of the Midwest and Southwest regions, 49.1% and 46.3% of participants, respectively, expressed lack of trust. In densely populated areas, such as the greater Tunis area, this number rose to 53.2%. This data underscores a crisis of trust in Tunisian healthcare services.[62]

The data reveals a consistent pattern of dissatisfaction among the population, extending to both public hospitals and institutions responsible for health insurance such as the Caisse Nationale d'Assurance Maladie (CNAM). On average, 56.1% of respondents expressed dissatisfaction with the services provided by public hospitals during the same period. This discontent is particularly pronounced in the Midwest, Southwest, and Northwest regions, where satisfaction levels are notably lower at 56.7%, 66.5%, and 57.7%[63], respectively.

Similarly, dissatisfaction extends to health social security institutions, with around 21.9% of respondents reporting dissatisfaction. The primary reason cited is the lack of coverage of certain medical procedures. The discontent also spills over into centres offering social care and assistance, where 49.1% of individuals reported being dissatisfied. Regionally, this dissatisfaction peaks at 58.5% in the Midwest and 58.1% in the Southwest regions.[64]

The decline in public health services over the years has made them increasingly inaccessible, as evidenced during the COVID-19 pandemic. According to an INS survey conducted between April and May of 2020, some 37% of respondents who required medical assistance were unable to access it, and 13% of those cited a lack of financial resources as the primary reason.[65] This rate rises to nearly 50% for the poorest households. These findings underscore the shortcomings of the existing health insurance program when confronted with the pandemic.[66]

Conclusion and Recommendations

The social protection system in Tunisia has been hailed as one of the “more advanced and protective models in the Middle East and North Africa (MENA) region”[67]. However, as this paper has shown, the system's mix of contributory and non-contributory schemes is inherently fragmented and exclusionary, and is characterised by discriminatory practices. These dynamics have intensified in recent decades due to interventions by the IMF and ensuing austerity measures that have been detrimental to social protection programs. Consequently, these developments have exacerbated social inequalities and increased the vulnerability of certain segments of the population considered to be at risk.

While the contributory system is geared toward those workers who are formally employed in the public and private sectors, it leaves out a significant number of informally employed workers and the unemployed. Various social assistance programs were ostensibly designed to address the deficiencies of the social security schemes. However, the prevailing social inequalities in Tunis, coupled with high unemployment rates, stark income disparities, and restricted access to certain benefits among the targeted populations, underscore the system's limitations and its inability to adequately safeguard individuals against various risks and vulnerabilities.

Therefore, the primary objective of any reforms should be the expansion of schemes, services, and beneficiaries, alongside the elimination of discriminatory and restrictive practices and programs. The focus should be on transitioning from a needs-based poverty-targeting approach to a universal rights-based approach, one that aims to provide coverage to a larger population, offer greater benefits and encompass a wider range of risks. Consequently, the recommendations extend to reforms related to the social protection system as a whole, its various programs, as well as specific policies.

Unemployment Insurance and Pension Plan

Workers in both the formal and informal sectors require access to unemployment insurance and pension plans. Informal workers, for instance, could be included in pensions and unemployment insurance programs through government-sponsored, voluntary, long-term savings initiatives.[68] Within this framework, these workers can allocate a portion of their earnings to long-term savings accounts. Incentives can be used to encourage enrollment, such as providing a percentage match when contributions reach a certain threshold or offering higher interest rates for consistent contributions. Pilot programs tackling this issue are already in place in countries such as Thailand and Rwanda.

Improved access for migrants

Additional reforms should guarantee migrants' access to social protection programs. For example, in February 2023, amid significant anti-migrant sentiments expressed by both the public and the state, multiple incidents of migrants being refused access to healthcare and other social services were documented.[69] [70] Therefore, legislative and implementation processes should be reformed to prevent a repeat of such discriminatory practices.

Re-defining poverty

Definitions of poverty and its thresholds must be re-evaluated to reflect multidimensional perspectives. However, due to the exclusionary nature of poverty-targeting programs resulting from flawed definitions, outdated data, and inefficient delivery mechanisms, a higher priority should be placed on a universal program that ensures social protection for a wide range of beneficiaries.

Reallocation to public social expenditures

To ensure the financial sustainability of these programs, the state needs to create the necessary fiscal instruments through taxation and a reallocation of resources that meet the principles of tax justice and equity.

An example of policies that can be adopted include:

- Increasing progressive personal income tax through a higher number of brackets and a higher marginal tax rate, which currently stands at a low of 35%.

- Increasing the corporate income tax (currently at 15%).

- Invest in resolving tax fraud and tax evasion. As it stands, 46% of Tunisians who registered corporations failed to file their taxes.[71]

- Redirect resources from other sectors such as the police and defence, whose budgets have expanded since 2011. The de-securitization of social issues is necessary to ensure social justice and equity.

Re-assessment of public social expenditures

Financing should not solely be directed toward establishing new programs and broadening the scope of beneficiaries; it should also be channelled into enhancing and strengthening existing services. This includes addressing challenges such as understaffing and underfunding within the healthcare sector.

The problems of the healthcare sector were rudely exposed during the COVID-19 pandemic. To prevent avoidable mortalities in the future, the government must lift the current public sector hiring freeze imposed since 2016 (as directed by the IMF) and increase the recruitment of medical staff, including doctors, nurses, midwives, and medical technicians. The government should also allocate resources to upgrade medical equipment to comply with international standards.[72]

The same problems associated with understaffing and under-funding can be found in the education sector. According to the World Bank, the decline in the quality of education is the primary factor contributing to the fall in Tunisia's Human Development Index (HDI). Challenges created by issues such as delays in teacher assignments, inadequate wages, and a growing dependence on short-term contracts have led to a number of problems, including a delayed start of the school year, teacher strikes, protests, and grading boycotts.[73]

Offering teachers long-term contracts and fair wages would guarantee the essential job security they need to develop their skills as well as foster meaningful learning relationships with students and the wider community.

Bibliography

Websites

Al Bawsala. "Marsad Budget." https://budget.marsad.tn/ar/.

Attasia TV. "Dialogue with the Finance Minister." November 3, 2022. Accessed via YouTube, https://www.youtube.com/watch?v=AkIyLPMwPbM&t=3229s&pp=ygUdbWluaXN0cmUgZGVzIGZpbmFuY2VzIHR1bmlzaWU%3D.

Attia.K and Mechmech.S. "A Decade of Austerity." https://www.albawsala.com/files/2022/11/A-decade-of-austerity-en-f.pdf.

CeSSRA. "Timeline: Social Protection in Tunisia | February, 1959 to January, 2019." June 2022.

Mars, H. "Structural Adjustment Program of IMF and World Bank: Case of Tunisia." https://archives.kdischool.ac.kr/bitstream/11125/30311/1/Structual%20adjustment%20program%20of%20IMF%20and%20World%20Bank.pdf.

Ministry of Commerce. "Sale Prices for Subsidized Products." 2021. https://commerce.gov.tn/prix-a-la-consommation-des-produits-homologues_11_30.

Ministry of Social Affairs. "ENQUETE D’EVALUATION DE LA PERFORMANCE DES PROGRAMMES D’ASSISTANCE SOCIALE EN TUNISIE." http://www.cres.tn/uploads/tx_wdbiblio/resume_executif_3_avril_2015.pdf.

Ministry of Social Affairs. "Social Security." https://www.social.gov.tn/en/social-security-0.

National Institute of Statistics. "Enquête Nationale Sur La Perception Des Habitants Envers La Sécurité, Liberté et La Gouvernance Locale En Tunisie 2021 | INS." Accessed 19 March 2023. http://www.ins.tn/publication/enquete-nationale-sur-la-perception-des-habitants-envers-la-securite-liberte-et-la-0.

National Institute of Statistics. "L’impact socio-économique du COVID-19 sur les ménages |1ère vague | INS." 2020. http://ins.tn/publication/limpact-socio-economique-du-covid-19-sur-les-menages-1ere-vague.

National Institute of Statistics. "Indicateurs de l’emploi et du chômage, Deuxième trimestre." 2023. https://www.ins.tn/publication/indicateurs-de-lemploi-et-du-chomage-deuxieme-trimestre-2023.

National Institute of Statistics. "Indicators on informal work 2019." September 2020. http://www.ins.tn/publication/indicateurs-sur-lemploi-informel-2019.

National Statistics Institute. "Inflation." February 2023. Accessed 20 March 2023. http://www.ins.tn/statistiques/90.

National Statistics Institute. "Growth." Trimester 4, 2022. Accessed 20 March 2023. http://www.ins.tn/statistiques/153.

National Statistics Institute. "Unemployment." Trimester 4, 2022. Accessed 20 March 2023. http://www.ins.tn/statistiques/153.

UNDP. "Informality and Social Protection in African Countries: A Forward-looking Assessment."

UNESCWA. "Social Expenditure Monitor for Tunisia: Towards making public social expenditure more equitable, efficient and effective." 2022.

World Bank. "Consolidating social protection and labor policy in Tunisia: building systems, connecting to jobs - policy note (English)." Washington, D.C.: World Bank Group. 2015.

World Bank. "Tunisia Systematic Country Diagnostic: Rebuilding Trust and Meeting Aspirations for More Prosperity and Inclusion." November 2022. https://www.worldbank.org/en/country/tunisia/publication/tunisia-systematic-country-diagnostic-rebuilding-trust-and-meeting-aspirations-for-more-prosperity-and-inclusion#:~:text=The%20Tunisia%20Systematic%20Country%20Diagnostic,meeting%20citizen%20aspirations%2C%20and%20ultimately.

World Bank. "ASPIRE: THE ATLAS OF SOCIAL PROTECTION - INDICATORS OF RESILIENCE AND EQUITY." Accessed March 10, 2023. https://www.worldbank.org/en/data/datatopics/aspire/indicator/social-expenditure.

World Bank. "Informality and Formality - Two Ends of the Employment Continuum." Accessed October 5, 2023. https://blogs.worldbank.org/jobs/informality-and-formality-two-ends-employment-continuum.

World Bank. "Out-of-Pocket Expenditure (% of Current Health Expenditure) - Tunisia." World Bank Open Data. Accessed September 27, 2023. https://data.worldbank.org/indicator/SH.XPD.OOPC.CH.ZS?locations=TN.

World Bank. "Poverty and Inequality Platform." Accessed March 11, 2023. https://pip.worldbank.org/country-profiles/TUN.

Books and Reports:

Ben Cheikh, Nidhal, and Jean Yves Moisseron. "The Effects of Social Protection on Informal Employment: Evidence from Tunisia." In Social Policy in the Islamic World, edited by Ali Akbar Tajmazinani. 2021. International Series on Public Policy. Cham: Springer International Publishing. https://doi.org/10.1007/978-3-030-57753-7_9.

Bierbaum, Mira, and Valérie Schmitt. "Investing more in universal social protection: Applying international social security standards in social protection policy and financing." No. 43. ILO Working Paper, 2022.

De Koster A. in collaboration with Oechslin E., Trabelsi M. and M. Said. "Social Dialogue in Morocco, Tunisia, and Jordan: Regulations and Realities of Social Dialogue." November 2015.

Economic and Social Commission for Western Asia (ESCWA). "Social Protection Country Profile: Tunisia." 2016.

François-Xavier Merrien. "Social Protection as Development Policy: A New International Agenda for Action." International Development Policy | Revue internationale de politique de développement.

Gelb, Laura, and Mohamed Ali Marouani. "Access to Social Protection by Immigrants, Emigrants and Resident Nationals in Tunisia." In Migration and Social Protection in Europe and Beyond (Volume 3). 2020.

ILO. "World Social Protection Report 2017-19: Universal Social Protection to Achieve the Sustainable Development Goals." Geneva: International Labour

[1] The ILO Social Security (Minimum Standards) Convention (No.102) , General Conference of the International Labour Organisation, 35th session, 1952, URL; Social Protection Floors Recommendation ILO Recommendation R202, General Conference of the International Labour Organisation, 101st session, 2012, URL.

[2] World Bank ,“Informality and Formality - Two Ends of the Employment Continuum”, World Bank Blogs, January 21, 2016, URL.

[3] The National Institute of Statistics, “Evolution of the consumer price index by year of base”, Statistiques Tunisie, URL (Accessed March 20, 2023).

[4] The National Institute of Statistics, “Unemployed evolution by sex”, Statistiques Tunisie, URL (Accessed March 20, 2023).

[5] Arnout De Koster et al., Social Dialogue in Morocco,Tunisia and Jordan Regulations and realities of social dialogue, European Commission, European Commission & ITC-ILO, 2015, 15.

[6] World Bank, Consolidating Social Protection and Labor Policy in Tunisia: Building Systems, Connecting to Jobs, The World Bank , World Bank Group Maghreb Department Middle East and North Africa Region, 2015,38, URL,

[7] The Gini coefficient is an indicator on how unequally resources are allocated in a community.

[8] World Bank, Tunisia Systematic Country Diagnostic: Rebuilding trust and meeting aspirations for a more prosperous and inclusive Tunisia, The World Bank, World Bank Group, 2022, 9, URL,.

[9] CeSSRA, “Timeline: Social Protection in Tunisia | February, 1959 to January, 2019”, Civil Society Knowledge Centre, June 2022, URL.

[10] Siham El Bou Ghdiri Nimsiyya, Dialogue with the Finance Minister (Video), Youtube Video, 01:45, Attasia TV, November 3, 2022, URL .

[11] ILO. World Social Protection Report 2017-19: Universal social protection to achieve the Sustainable Development Goals, Geneva: International Labour Organization, 2017, URL (Accessed March 11, 2023).

[12] Mira Bierbaum and Valérie Schmitt, Investing better in universal social protection: Applying international social security standards in social protection policy and financing, ILO Working Paper No. 43, January 2022, URL.

[13] International Labour Organization, Social protection assessment-based national dialogue: A global guide, Geneva, International Labour Organisation, 2016, 6, URL (Accessed March 11, 2023).

[14] International Labour Organisation, Universal Social Protection: Key concepts and international framework,International Labour Organisation, 2019, 2, URL.

[15] Ibid.

[16] François-Xavier Merrien, “Social Protection as Development Policy: A New International Agenda for Action”, International Development Policy | Revue internationale de politique de développement, Issue No. 4.2, 89-106, URL.

[17] United Nations Economic and Social Commission for Western Asia (ESCWA), “Social Protection Country Profile: Tunisia”, ESCWA Statistics Online, URL.

[18] Republic of Tunisia, Ministry of social affairs, “Social Security”, URL.

[19] United Nations Economic and Social Commission for Western Asia (ESCWA), “Social Protection Country Profile: Tunisia”, ESCWA Statistics Online, URL.

[20] Mars Hedi, “Structural Adjustment Program of IMF and World Bank: Case of Tunisia”, (Master of Public Policy Thesis, KDI School of Public Policy and Management, 2011), 23-24, URL

[21] Kais Attia and SaharMechmech, “A decade of Austerity”, Al Bawsala, (2022), 6, URL.

[22] Republic of Tunisia, Ministry of Commerce, “Sale Prices for Subsidized Products”, URL.

[23] CeSSRA “Timeline: Social Protection in Tunisia | February, 1959 to January, 2019”, Civil Society Knowledge Centre, June 2022, URL.

[24] Republic of Tunisia, Ministry of Social Affaires, “ENQUETE D’EVALUATION DE LA PERFORMANCE DES PROGRAMMES D’ASSISTANCE SOCIALE EN TUNISIE”, URL .

[25] Emma Murphy, Economic and political change in Tunisia: From Bourguiba to Ben Ali, New York, St. Martin's Press in association with University of Durham, 1999, 109.

[26] United Nations Economic and Social Commission for Western Asia (ESCWA), “Social Protection Country Profile: Tunisia”, ESCWA Statistics Online, URL.

[27] The formula relates the SMIG and the number of individuals in the household, the exact formula is in the reference cited below.

[28] Ibid.

[29] The National Institute of Statistics, “Indicateurs de l’emploi et du chômage, Deuxième trimestre. 2023”, Statistiques Tunisie, URL.

[30] The National Institute of Statistics, “Indicators on informal work 2019, September 2020”, Statistiques Tunisie, 2020, 3 URL.

[31] Khaled Nasri, Mohamed Amara, and Imane Helmi. The Tunisian Social Protection System: Key Strengths and Challenges (Economic Research Forum, 2022), URL.

[32] Ibid.

[33] Nidhal Ben Cheikh and Jean Yves Moisseron. The Effects of Social Protection on Informal Employment: Evidence from Tunisia, Palgrave Macmillan, Cham, 2020, 187-223 URL .

[34] Ibid.

[35] Ibid.

[36] Ibid.

[37] The National Institute of Statistics, “Indicateurs Sur l’emploi Informel 2019”, Statistiques Tunisie, URL (Accessed 22 March 2023).

[38]Ibid.

[39] Laura Gelb and Mohamed Ali Marouani, Access to Social Protection by Immigrants, Emigrants and Resident Nationals in Tunisia, Springer, Cham, 2020, 363, URL.

[40] Ibid.

[41] Republic of Tunisia, Ministère des Finances, Rapport d'analyse budgétaire selon le genre (2010-2021) (Ministère des Finances, 2022), 19.

[43] The World Health Organization (WHO) recommends at least 6-months of exclusive breastfeeding for infants, if possible.

[44] UNESCWA, “Social Expenditure Monitor for Tunisia. Towards making public social expenditure more equitable, efficient and effective”, UN ESCWA information paper (Beirut: UN ESCWA, 2022), 13, URL

[45] Ibid, 22

[46] Sahar Mechmech and Houssem Chammem, “Austerity: A Chronic Condition of Public Health”, Al Bawsala, 2022, URL (Accessed 20 February, 2023).

[47] “Out-of-Pocket Expenditure (% of Current Health Expenditure) - Tunisia”, World Bank Open Data, Accessed September 27, 2023. URL .

[48] Sahar Mechmech and Houssem Chammem, “Austerity: A Chronic Condition of Public Health”, Al Bawsala , 2022 , URL , (Accessed 20 February, 2023).

[52] UNESCWA, “Social Expenditure Monitor for Tunisia. Towards making public social expenditure more equitable, efficient and effective”, 24.

[57] Caroline Criado Perez, Invisible women: Data bias in a world designed for men, (Abrams Press, 2019).

[61] Ibid.

[62] The National Institute of Statistics, Enquête Nationale Sur La Perception Des Habitants Envers La Sécurité, Liberté et La Gouvernance Locale En Tunisie 2021, Statistiques Tunisie, 2022, URL.

[63] Ibid.

[64] Ibid.

[65] The National Institute of Statistics and The World Bank, Suivi de l’impact socio-économique du COVID-19 sur les ménages tunisiens, Statistiques Tunisie, 2020, URL.

[66] Ibid.

[67] CeSSRA, “Timeline: Social Protection in Tunisia | February, 1959 to January, 2019”, Civil Society Knowledge Centre, June 2022, URL.

[68] UNDP and ILO, Informality and Social Protection in African Countries: A Forward-looking Assessment, (New York: UNDP, 2021), URL.

[69] Human Rights Watch, Tunisie : La Violence Raciste Cible Les Migrants Et Réfugiés Noirs, Human Rights Watch, March 11, 2023, URL .

[70] Rihab Boukhayatia, Accès Aux Soins En Tunisie: Les Migrants Marchent Ou Crèvent , Nawaat, 7 June 2022, URL.

[71] Mohamed Haddar and Mustapha Bouzaiene, Ancrage de la Justice Fiscale et Mobilisation des Ressources, ASECTU, 2017.

Sahar Mechmech works as a Public Policy Analyst at the Ali Ben Ghedhahem Center for Fiscal Justice, where she focuses on issues related to taxation, gender, and social protection in the MENA region.

Kais Attia is a Public Finance and Public Policy Analyst at Al Bawsala, with a background in analysing the impact of austerity measures on marginalised groups.