Reforming the Lebanese Tax System: A Pillar of Sustainable Universal Social Protection

Publication Date:

November, 2023

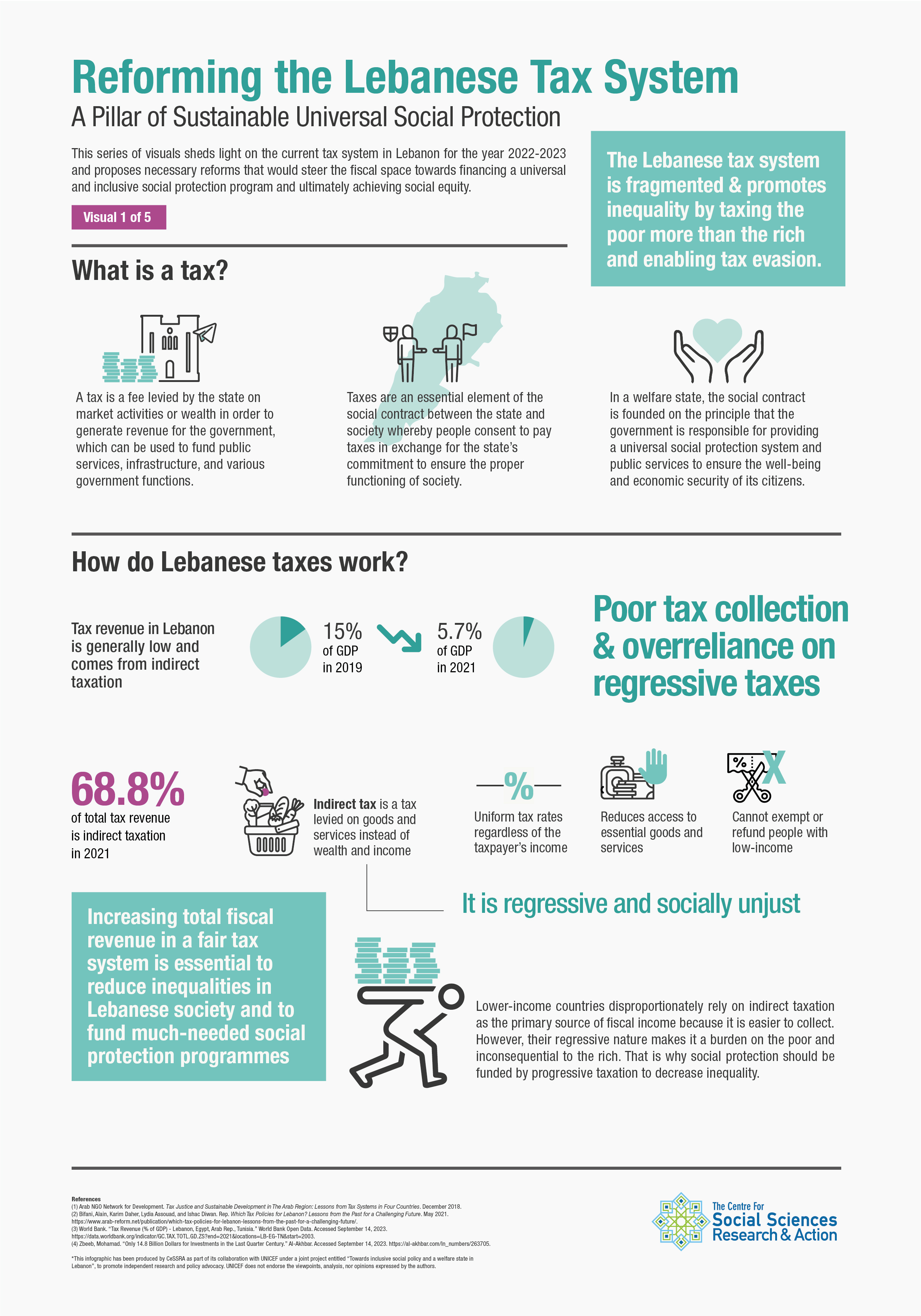

The Lebanese tax system is fragmented and promotes inequality by taxing the poor more than the rich and enabling tax evasion. A fair tax system is essential to reduce inequalities in Lebanese society and to fund much-needed social protection programmes. This visual sheds light on the current tax system in Lebanon for the year 2022-2023 and proposes necessary reforms that would steer the fiscal space towards financing a universal and inclusive social protection program and ultimately achieving social equity.

Reforming the Lebanese Tax System: A Pillar of Sustainable Universal Social Protection - Visual 1 of 5

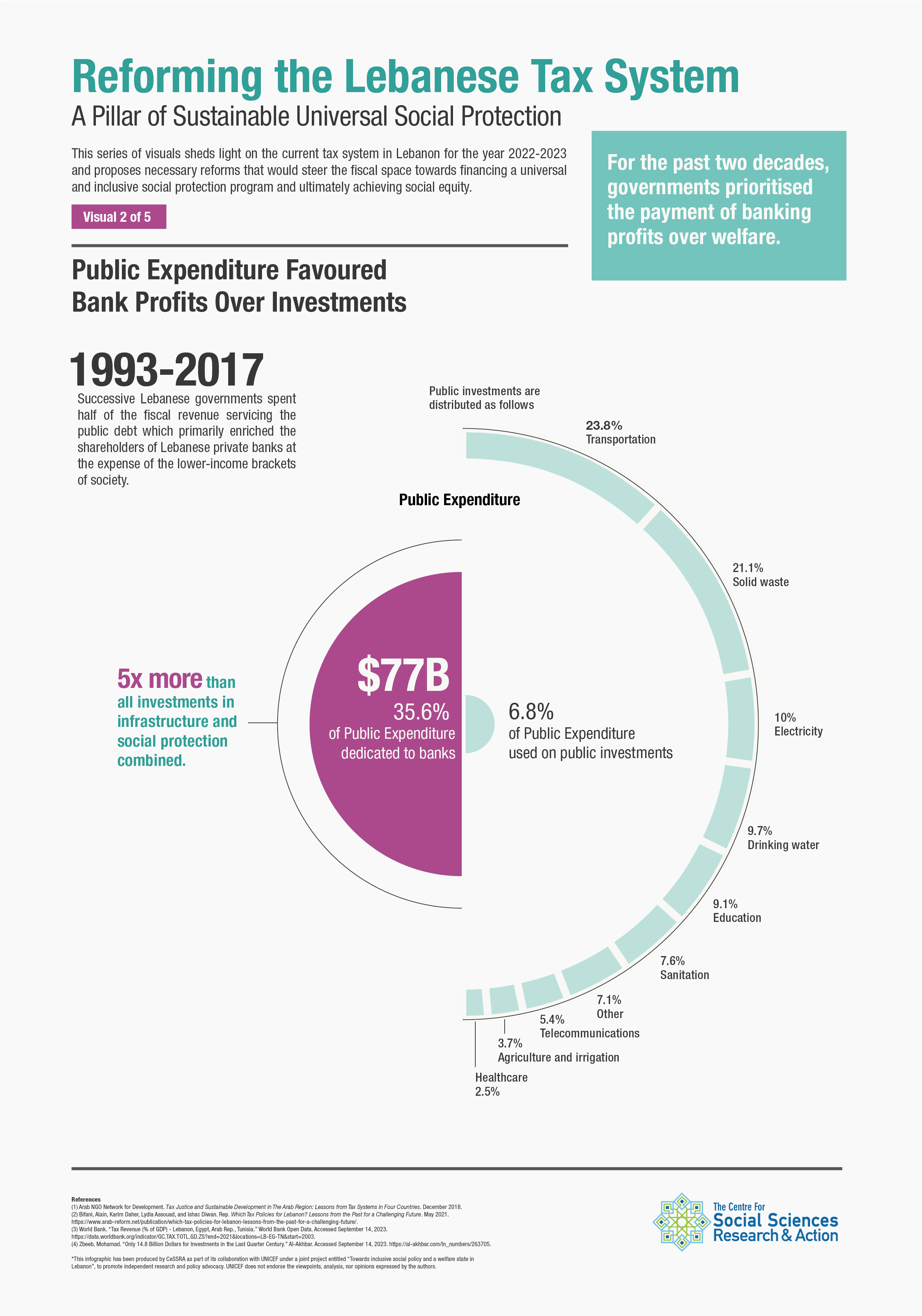

Reforming the Lebanese Tax System: A Pillar of Sustainable Universal Social Protection - Visual 2 of 5

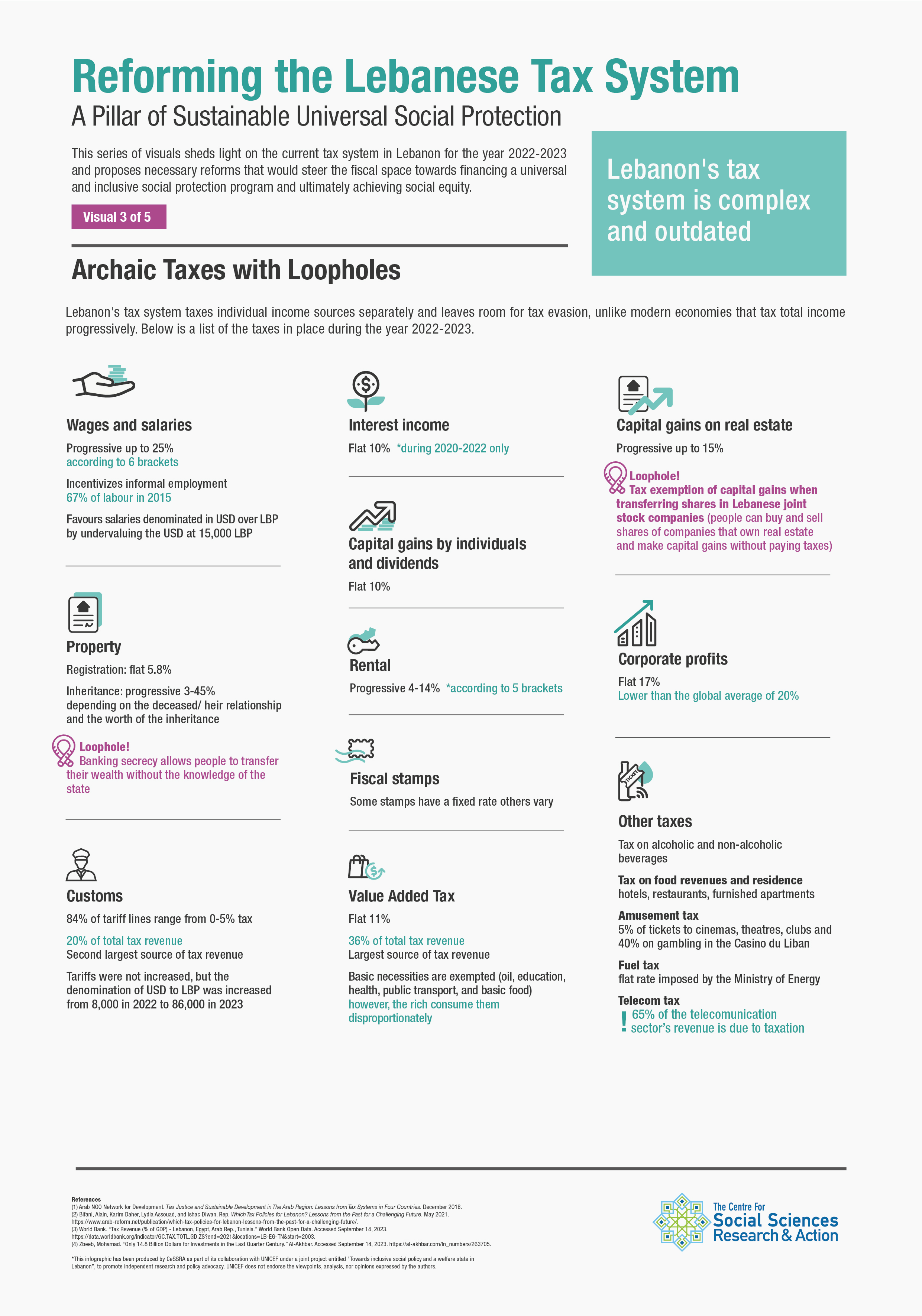

Reforming the Lebanese Tax System: A Pillar of Sustainable Universal Social Protection - Visual 3 of 5

Reforming the Lebanese Tax System: A Pillar of Sustainable Universal Social Protection - Visual 4 of 5

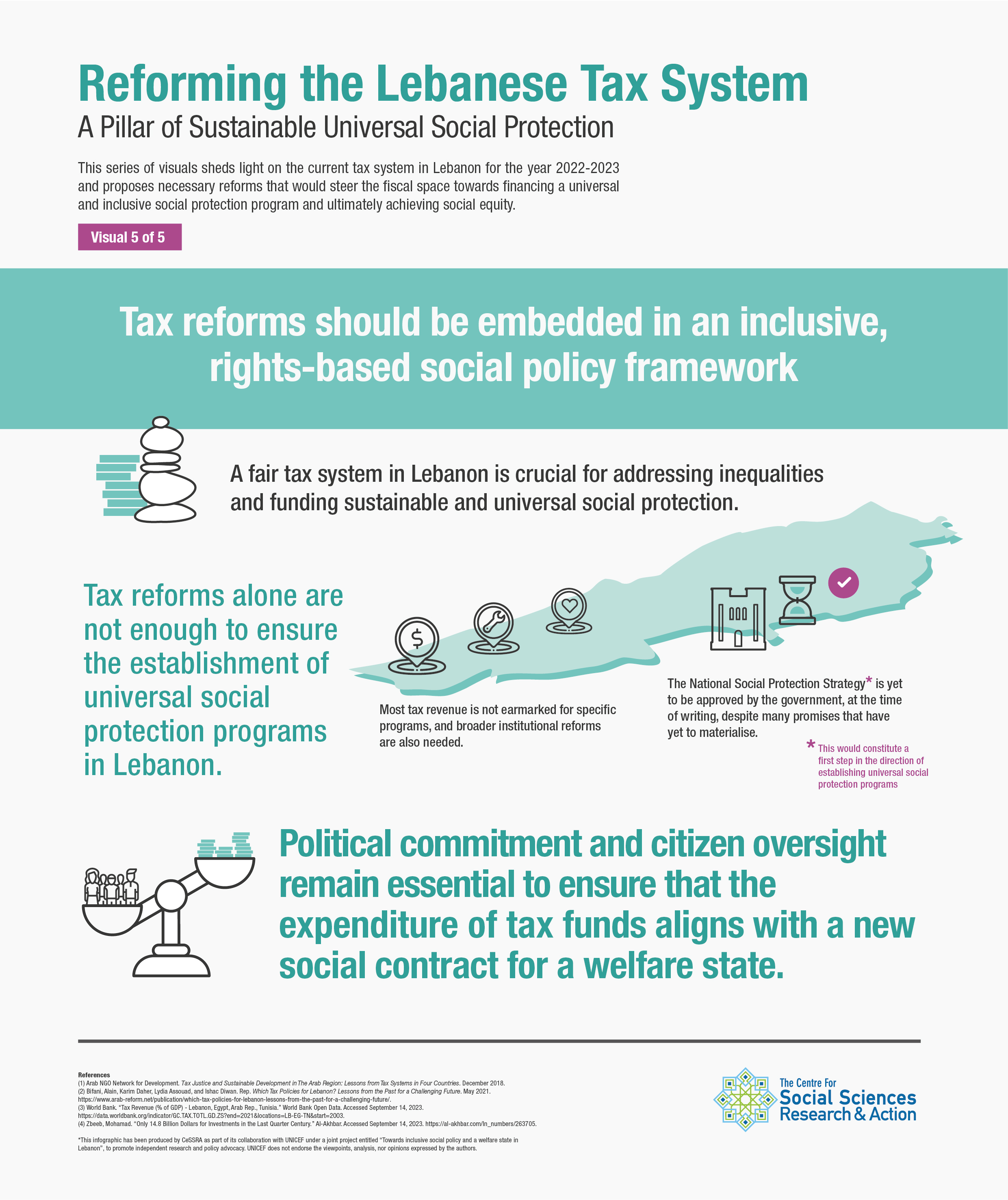

Reforming the Lebanese Tax System: A Pillar of Sustainable Universal Social Protection - Visual 5 of 5

Valerie Nseir

Dossier:

Socio-Economic Rights Base, Conflict Analysis Project

Embed this content:

Copy and paste this code to your website.